This is a rather long commentary so it's important not to bury the lede... The point of the analysis provided below is this:

Skyrocketing insurance costs are not solely a reflection of opportunistic insurance companies applying the screws to consumers. Typical corporate greed may not even be twenty percent of the root problem. Instead, skyrocketing insurance rates reflect a fundamental shift in the profile of risks facing property owners and insurers alike -- shifts in risk which classic insurance business models cannot distribute across time and customers to allow financial protection to be provided profitably. Skyrocketing rates in many areas may still not accurately reflect the true risks posed to customers and insurers alike. These drastic changes have significant implications for INVESTORS in insurance and construction-related businesses. They have even greater implications for INDIVIDUALS in their personal lives, whether someone choosing to start a career in a particular location, someone considering moving mid-career to a new region or someone considering retiring to a new area facing increases in weather extremes. Making such decisions without contemplating these risks could result in life-altering financial disaster -- an AVOIDABLE life-altering financial disaster.

Most consumers understand that insurance rates have risen substantially and there are obvious events taking place that are triggering some of those increases. However, mere intuition may not adequately convey to everyone with an interest HOW volatile insure markets are likely to remain. More importantly, not everyone will immediately understand the PERSONAL financial risks they are assuming when all of the big players adjust their hands at the table. Conveying that level of clarity requires providing a clear explanation of how insurance works as a financial product and a visualization of how current events overwhelm the traditional mechanics of insurance as a product.

All of this has been attempted here by devising a mathematical model reflecting current insurance processes then feeding current market inputs (home prices, premium payments, claim statistics) to that model to validate it produces realistic results. Once validated, new inputs were provided reflecting higher disaster event rates to see how rapidly the outputs change. Those market dynamics are then discussed, then related to more individual concerns.

Insurance in a Nutshell

Insurance is a financial service sold on a mass market basis using boilerplate contracts. The service involves the insurer agreeing to pay large sums of money to the customer for specific, carefully proscribed events IN EXCHANGE for the customer making a series of much smaller payments to the insurer. The net result of the contract is an arrangement in which the customer pays for POTENTIAL future losses on an installment plan and the insurer pays for covered damages in full at the time they occur in exchange for a profit. Both parties consider it a win if the customer doesn't face an outsized, uncovered loss and if the insurer accurately predicts the probability of a customer loss and sets premium levels accordingly.

Consumers want to buy the product because it appears to prevent them from being hit with a giant cash expense to fix/replace something they already own. Even if the customer is financially and economically literate enough to understand their own premiums essentially pay for their eventual losses, they are not likely to understand the statistics related to the frequency of loss events to do the math on their own and simply save for the potential loss. In many cases, a customer may understand the idea of "self-insurance" but realizes the loss could come well before they've saved enough to cover it themselves.

Insurers can sell coverage profitably because they can collect statistics across THOUSANDS of customers to accurately predict loss rates and costs, set appropriate premium levels, then optimize claims processing for efficiency. Since premiums are collected across ALL customers but a very small fraction of customers actually file claims in any given period, that asymmetry usually results in premiums exceeding payouts and profits for the insurer, provided their statistics remain valid.

In a typical worse-case world, insurers themselves can minimize their financial risk by purchasing their own insurance, called re-insurance. Re-insurance works similarly to insurance as a product, only with a different financial entity as the "insurer" (the "re") and the original insurer as the customer. The concept of a deductible also appears in re-insurance, requiring the insurance company customer to eat the first $XXX million of losses in a given year or over an period of years before re-insurance coverage kicks in. This provides an incentive for the original insurer to remain diligent about its sales tactics, pricing and claim processing / validation to eliminate avoidable losses rather than immediately transferring all losses to the re-insurer.

The insurance model works well for LARGE, randomly occurring costs. The model is NOT an efficient solution for handling SMALL, perfectly predictable ROUTINE costs. A deductible amount is usually applied to each claim to avoid using an insurance model to pay for small claims whose paperwork costs exceed the cost of the claim being processed. As an example, auto insurance policies don't include the cost of routine oil changes because no insurance company can process a claim for $49.95 and the need for an oil change is so predictable that if the customer cannot plan for routine $49.95 oil changes, they cannot afford the vehicle. Any insurance company that DID cover oil changes would likely add $300 dollars to the yearly policy --- $150 for oil changes and $150 for back-office paperwork fees, resulting in no net benefit to the customer. Deductibles also serve to apply some pain to the customer for each claim event to avoid the "moral hazard" of the customer feeling like they don't have to avoid taking undue risks with the asset since they won't pay anything out of pocket for damages.

The Consumer's Cash Flow Problem

Insurance benefits the customer by transferring the risk of incurring a single LARGE expense to another party in exchange for paying a smaller series of premiums which fit into the customer's cash flow. If a customer purchases a home for $248,700 with a 30 year fixed mortgage at 7% and 20% down payment ($49,740), they will borrow $198,960 and carry a monthly mortgage payment of $1446. Given they had to borrow money to afford the house the first time, they likely cannot afford to REBUILD the house if it is totally destroyed during that same period, so they purchase insurance. For insurance to be worth the cost to the consumer, the consumer must believe insurance premiums are cheaper than the loss eventually incurred over the term. If there is a 100% chance a hurricane will completely destroy the home over 41 years, the expected loss over that period is $248,700. Ignoring inflation momentarily, that means the sum of premiums cannot exceed $248,700 so the customer would need to pay a yearly premium of $248,700 / 41 or $6066 per year.

If the customer KNEW the loss would be incurred in year 41 and they had the discipline to save money, they would of course be better off just saving $6066 per year and setting it aside for year 41. Of course, most consumers DON'T have that discipline so they opt for insurance. They also opt for insurance because the loss COULD occur in year 2 when they would have only saved $12,132 on their own.

KEY TAKEAWAY -- Purchasing insurance doesn't eliminate financial risk, it transforms it by spreading it out over a long period of time for the consumer and allows the short term cost to be covered by a larger financial entity with sufficient cash flow for the large outlay.

The Insurer's Cash Flow Problem

Absent any inflation and its effect on present value, the timing of the loss makes no difference to the profitability to the insurer. As long as premiums collected exceed the expected loss over the term (which requires the insurer to continue offering coverage and requires the consumer continue paying premiums), the insurer makes money.

When inflation and the time value of money ARE factored in, the TIMING of the loss within the term has a DRASTIC impact on the net profitability of selling a policy. When the loss is incurred many years into a long term, the discounting impact on those future claim outlays back to present dollars reduces the net cost of the claim. In the mean time, the insurer has been able to take dollars paid in premiums to invest and earn a return on to use for later claims. If a loss is incurred EARLY in the term, it drastically increases losses for the insurer. At a 4% discount rate, shifting a total loss of $248,700 from year 41 back to year 0 changes the net income from this example policy from +$74,327 to negative $122,571.

KEY TAKEAWAY -- Shifting the timing of claims from the future to the present increases net cost to the insurer.

The impacts of timing for consumers and insurers are illustrated in the video here:

The Insurer's Loss Correlation Problem

So if an earlier claim on a policy poses a risk of a loss to the insurer, how does the insurer mitigate that risk? By selling similar coverage to similar customers. This works provided that loss events do not have a high degree of correlation in time and value BETWEEN multiple policy holders. For example, if the risk of a total loss due to an electrical malfunction and fire is 100% over 41 years, an insurer selling $248,700 of coverage for $6066/year will only collect $126,128.97 in present value for premiums over that period. If the house burns down in year zero, the insurer will lose ($248,700 - $126,128.97) or $122,571 dollars if that is their only customer. However, if they sell 100 identical policies, the odds of electrical fires are not correlated BETWEEN homes so the other 99 policies might still generate as much as $74,327 each in income, balancing out the loss on policy #1. At a 4% discount rate, the insurer's "break even" time horizon is about 17.5 years. Measured from the beginning of a policy relationship, the insurer can make money even for total losses if the loss is incurred more than 17 years in the future.

KEY TAKEAWAY -- Insurers can reduce timing risk by selling to multiple customers for loss types (plumbing, casualty/theft, roofing, minor fire, etc.) which have no statistical correlation to each other.

But therein lies the key problem facing insurers. Regardless of whether one believes climate change is the root cause, actual events reflect:

- an increase in the number / severity of hurricanes

- an increase in the number / severity of flood events

- an increase in the number / severity of wildfire events

These type of events violate the statistical assumptions behind the primary mechanics of risk spreading within insurance because the loss timing is SIMULTANEOUS across hundreds of policies and loss value tends to be near 100% (actually probably close to 150% including home contents).

The Insurer's Time Horizon / Re-Insurance

Insurers make higher profits as losses are shifted into the future. Insurers spread the risk of losses incurred closer to the present by selling coverage to multiple customers and betting losses will NOT be tightly correlated in time. So how do insurers cover the risk of an unexpected spike of claims in the near term? Two ways --- either by raising premiums to build a "cushion" that can smooth out profits over say a 3-5 year span OR by purchasing re-insurance from another firm. In fact, most firms use both of these strategies.

No insurance company literally sells insurance for exactly the present value of expected future losses -- doing so would yield exactly zero in profit. The premium amount collected always includes a margin which not only covers the firm's desired yearly profit margin it wants to provide its investors and management but also provides a stash of cash to cover claims for a particularly bad year. But retaining an extra billion dollars in cash year to year when average claims total $500 million and premium payments total $600 million is not desirable either. To avoid stranding so much cash as a cushion, insurers buy their own insurance to guard against outsized claims in any given year. This lowers the amount of cash they have to keep on hand, allowing them to invest it to earn additional profits. Firms selling re-insurance, generally referred to as "Res", spread this form of risk by selling re-insurance to multiple insurers across a much wider swath of geography. Thus, a Re selling re-insurance to Mutual of Florida and to Mutual of Michigan can lower the net risk of either firm having a cash flow problem due to a bad claim year under the assumption that the odds of BOTH firms having a bad claim year are extremely low since Michigan doesn't face hurricanes and Florida doesn't face risks from blizzards and lake effect snow events.

KEY TAKEAWAY -- Re-insurance can spread risk BETWEEN insurers with different policy portfolios whose risks and geography are NOT highly correlated.

Risk Shedding Caveats

There are several important caveats to the "risk-shedding" aspect of the insurance process. Events involving high simultaneity ACROSS customers magnify cash outlays of the insurer. This is an inevitable problem with natural disasters such as floods, tornados, hurricanes, wildfires and earthquakes. These events have an "impact radius" or "impact path" that triggers losses among many co-located customers. An insurer cannot spread this risk by selling more policies in that area. Doing so would increase claims at that same point in time.

A second caveat to risk shedding is that geographically clustered losses can be further magnified by geographic skewing of coverage. That's an analytical way of stating that disasters and home buyers seem attracted to the same amenities -- beaches, mountain views, scenic rivers, etc. -- and such locations tend to magnify damages from weather events near them. Insurers with policies in such locations can experience significantly higher losses, first due to the proximity of customers hit by an event and the upward skewed loss amounts as a storm wipes out multi-million dollar homes rather than mere "average" $390,000 homes.

A key wildcard at work with insurance markets currently is that claims resulting from natural disasters are resulting in HIGHER costs than previously estimated by insurers. Again, this is not addressing the NUMBER of claims, this is addressing the resulting COST of each claim exceeding prior estimates. How can this happen? If an appraiser comes by a home, counts up the rooms, counts up the square footage, identifies the number of bathrooms, the finished square footage in the basement and the $20,000 Viking commercial range in the kitchen and says the house would cost $682,000 to rebuild, that number MIGHT hold if that single house is lost in a fire. In that circumstance, there is only one extra contractor in line at 84 Lumber and Appliances-R-Us to purchase replacement materials and only one additional crew needed for reconstruction. If instead that same $682,000 house is lost amid a wildfire or hurricane with 150 other similar homes, that house could cost $1,200,000 to rebuild after materials and labor costs skyrocket due to a spike in demand.

Who is at risk in this scenario? Predominately the homeowner. If coverage only provides for actual cash value, a home purchased for $600,000 with a dwelling that cost $500,000 to construct that is fifteen years old and in need of a new roof might only pay off $390,000. A mortgage lender may only require cash value coverage because the mortgage holder doesn't care if the owner has a place to live, they only care about having the mortgage paid off and a cash value policy will typically make them whole. If replacement cost coverage is purchased, it still relies upon the insurance company or homeowner accurately estimating the rebuilding costs -- often by looking at similar recent claims. Unless the customer requests a larger replacement value and pays a higher premium, that stated limit will apply if the house is lost entirely.

Finally, insurance companies and re-insurance companies must carefully analyze the actual risk diversification they achieve via re-insurance. A Re selling coverage to Mutual of Miami and Mutual of Tampa has not materially reduced any risk since both insurers likely serve customers with nearly identical exposure to hurricanes, storm surge, rising sea levels and related storm damage. A Re might not be materially improving its odds by selling re-insurance to firms serving the Carolinas or Virginia since many hurricanes hitting Florida follow a path up the East coast. A Re cannot necessarily improve its odds by selling re-insurnace to a firm in Texas or California either because they may face similar high risk of weather related disasters.

Designing a Model for Sensitivity Analysis

Besides the financial impacts of time and inflation on risk in insurance described earlier, the model programmed and interpreted here makes one additional crucial assumption. Insurance companies report their financial results reflecting two distinct sources of income. Underwriting Income shows the balance between current year premiums paid by policyholders and current year claims paid out, including related administrative claims processing expenses. Investment Income reflects profits made from investments made with the profits from underwriting each year. If an insurer is netting $15 million in underwriting profits each year over ten years, typically at least some of those $15 million dollar sums are being invested to return additional profits. Those additional profits can be used in two ways -- they can be paid back to stockholders as dividends to boost returns or they can be retained to provide a cushion for years where claims exceed premiums and underwriting losses are incurred.

In theory, underwriting income is the canary in the coal mine for an insurance company's future financial health. A firm failing to correct yearly underwriting losses will soon burn through any cushion created by investment income. As a result, this analysis will only focus on underwriting income simulated directly from premium payments and claim amounts.

To simplify performing the underlying calculations and summarizing the results intuitively, the model was coded using Python so the Manim (Mathematical Animation) library could be used to illustrate the results. For those curious about the mechanics, the organization and logic of the modeling are described below.

Insurance Model Components

The logic in the model was designed to reflect these attributes of an insurance market and policy:

| Value | the financial value of the asset being protected by policies |

| Event Probability | the likelihood of a damaging event occurring during an insured term |

| Loss Factor | the percentage of value of the protected asset destroyed by a damaging event |

| Premium | the amount paid by the customer for coverage |

| Deductible | the portion of loss (either a fixed amount or percentage of claim) born by the customer before insurance coverage kicks in |

| Customers | the total number of policies sold with a given combination of the above risk parameters |

| Path Diameter | reflection of how far damage extends from an event's origin point |

| Path Length | reflection of how far an event moves from origin to termination |

Modeling Location Density and Value

Calculations done using averages will only be accurate if events themselves are purely "average" and encounter "average" customers with "average" value properties. A key assumption being tested by this modeling is that climate-related events are NOT impacting "average" homes and instead may impact homes skewed to specific locations with upward skewed values. Rather than create a simple, evenly spaced "grid" of identical average customers, the model should be able to skew customer locations across the wider territory and skew assigned values for coverage for each customer.

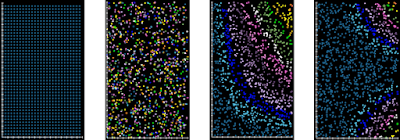

The model accomplished this by using random numbers to generate an initial (x,y) coordinate, using another random number to select against a statistical curve to weight whether to keep that (x,y) coordinate or try a new value. Once a final (x,y) was generated, that (x,y) coordinate was mapped to a 0-1 unit scale in the x/y directions to use those unit values to map through different gradients to use in scaling a coverage value from a starting average value and variance amount. The resulting logic supported any of the following distributions of customers by location and coverage value.

The first illustration reflects policies evenly distributed on a simple grid with the identical coverage value.

The second illustration reflects the same number of policies randomly distributed with random values.

The third illustration reflects the same number of policies randomly distributed with a skew to higher values in the northeast corner.

The fourth illustration reflects the same number of policies randomly distributed with a skew to higher values in both the northeast and southeast corners.

Modeling Loss Profiles

In the earlier examples, the cash flows of insurance were illustrated with just the premium stream paid by the customer and one single 100% loss event paid by the insurer. In reality, most customers never suffer a 100% loss but do incur minor claims over the period they stay with any given insurer. The Insurance Institute publishes statistics that identify the overall yearly claim rate and the types of claims and their associated loss. Descriptions and definitions vary from source to source but the model boiled down those statistics into the following categories of risk:

arrayLossProfiles = [

LossProfile(label="Plumbing" ,frequency=.236,lossfactor=.03,deductibleamt=1000,

deductiblepct=0.0,pathdiameter=.0057,pathlength=.0,color=PURE_GREEN),

LossProfile(label="Roofing" ,frequency=.371,lossfactor=.09,deductibleamt=1000,

deductiblepct=0.0,pathdiameter=.0057,pathlength=.0,color=YELLOW_C),

LossProfile(label="Fire" ,frequency=.24,lossfactor=.60,deductibleamt=1000,

deductiblepct=0.0,pathdiameter=.0057,pathlength=.0,color=PURE_RED),

LossProfile(label="Flood" ,frequency=.019,lossfactor=.75,deductibleamt=1000,

deductiblepct=0.0,pathdiameter=1.0,pathlength=1.0,color=BLUE_D),

LossProfile(label="Liabilty" ,frequency=.023,lossfactor=.09,deductibleamt=1000,

deductiblepct=0.0,pathdiameter=0.0057,pathlength=0.0,color=DARK_BROWN),

LossProfile(label="Vandalism",frequency=.094,lossfactor=.026,deductibleamt=1000,

deductiblepct=0.0,pathdiameter=0.0057,pathlength=0.0,color="#7F00FF"),

LossProfile(label="Tornado" ,frequency=.014,lossfactor=1.0,deductibleamt=1000,

deductiblepct=0.0,pathdiameter=0.028,pathlength=2.0,color=MDHGRAYGREEN),

LossProfile(label="Hurricane",frequency=.003,lossfactor=1.35,deductibleamt=0.0,

deductiblepct=0.02,pathdiameter=10.0,pathlength=15.0,color=PURE_BLUE)

]

For each entry, frequency is its rate of occurrance within the total claim rate. The lossfactor value is the modeled claim cost as a percentage of the total coverage value. Path diameter reflects the width of the impact circle of the event. For events limited to a single home, pathdiameter is set to 0.0057 miles or 30 feet. The pathlength parameter reflects the distance in miles impacted by the event. The entry for tornado with pathdiameter = 1.0 and pathlength = 3.5 reflects a tornado traveling 3.5 miles on the ground with a 1 mile wide impact along that route.

For most event types, the deductible is a fixed amount set to $1000. For hurricanes, the deductible instead is calculated as 2% of the loss value, which is typical for markets at risk of hurricane storms.

Modeling Events and Impacts

For a given model run, the defined customers value and claim rate were multiplied to yield the number of events to generate. At that point, a loop was run to randomly select a customer, retrieve that customer's (x,y) coordinate, then a random number was used to select an event type from the above array. The lossfactor of that event type was multipled by the customer's coverage amount then a deductible substracted from that for a final loss amount. When the pathlength of the selected loss profile was zero, logic just looked for any other customes with an (x,y) in the radius of the originally selected customer, then repeated the same loss calculation for each.

If the pathlength of the loss profile assigned was greater than zero, additional logic was used to calculate the (x,y) coordinate of the remote end of the path, then a circle around that (x,y) and a rectangle connecting the two.

The entire set of customers was again searched for any with an (x,y) within those areas, then the same loss calculations performed for each policy.

The pathangle shown in the calculation illustration above was always set to 45 degrees for tornados, representing a typical northeast direction taken by most tornados in the US. For hurricanes, if the storm struck on the eastern extreme of the territory, the path angle was set to 140 degrees, roughly northwest or slightly below. If the storm struck on the west extreme of the territory, the path angle was set to 45 degrees reflecting a northeast direction.

Sanity Checking the Model with Real Statistics

Prior to experimenting with changes to factors in the model, the underlying logic was sanity checked by attempting to mimic a real insurance market for which public statistics were available. Since Florida has been a topic of recurring conversations regarding disasters and insurance, the following information was programmed into the model:

- average home price in Florida is $390,000 (home price = cost of dwelling + cost of land)

- ignoring the panhandle area, the bulk of Florida is rougly 170 miles wide and 270 miles tall

- Florida has at least two concentrations of higher prices in Miami (southeast) and Jacksonville (northeast)

- average lot size in Florida is 11,043 square feet and average cost per acre across Florida is $34,900

- not easy to accurately derive dwelling cost from home sale price since real estate in expensive areas is obviously way above the state average -- for now, coverage will just be set to the average home sale price

- some sites show the average homeowner premium in Florida is $6066

- other sites such as NerdWallet reflect typical insurance rates between $1675 (Tallahassee) to $4105 (Miami) for $300,000 dwelling, $30,000 additional structures, $150,000 contents, $60,000 living expenses and $1000 deductible

- other sites indicate only 1 in 5 Florida residents have flood insurance and most homeowners insurance policies explicitly EXCLUDE damage from storm surge and flooding so these cheaper rates likely do not include full coverage

- other stories are showing flood insurance prices alone will be between $5077 and $7097 for the highest risk counties

- this modeling will assume that $6066 is a more accurate average of "full coverage" homeowners insurance on an "average" $390,000 home -- this implies average cost per $ of coverage is $6066/$390,000 = $0.0155 (so a customer with $1,000,000 in coverage would roughly pay $15,500 in premiums)

- insurers limit contents coverage to 50-75% of dwelling so a "total loss" could be 1.5 to 1.75 times nominal coverage amount of the dwelling

- nationwide yearly claim rate is 6% (insurer with 100,000 policies will field 6000 claims total per year)

- Florida has a total of 10,257,426 housing units, 66.5% of which are owned

- from that, assume 6.82 million policies

- Florida has 437 in-state insurers and 1651 out-of-state insurers - total of 2088

- the top 25 insurers in Florida range from 577,263 to 68,723 customers (4 million of the total)

- modeling a customer count of 68,000 would be a reasonable proxy for a single insurer

- nationwide, profit margins for property and casualty insurance are around 10% of revenue

- in FLORIDA, insurers have been averaging claims payout rates of 117.5% (for every $100 in premiums, insurers paid $117.50 in claims)

- insurers in Florida lost $1.5 billion (underwriting + investment losses) in 2021 when zero hurricanes struck the state

- until 2016, Florida insurers had made between $850 and $950 million in underwriting profits and similar amounts in investment gains

With these inputs captured from industry statistics and news reports, a model reflecting these parameters was run five times, constrained to have zero hurricanes, in order to baseline results for a single year.

| Simulation# | Premium Revenue | Claims | Profit (Loss) |

|---|---|---|---|

| 1 | $425,763,762 | $407,285,840 | $18,477,922 |

| 2 | $425,763,762 | $427,384,587 | ($1,620,825) |

| 3 | $425,763,762 | $415,986,924 | $9,776,838 |

| 4 | $425,763,762 | $406,627,639 | $19,136,123 |

| 5 | $425,763,762 | $426,320,161 | ($556,399) |

Across the five simulations with zero hurricanes, the insurer averages $9,042,732 in profits or about 2% of revenue. That's worse than reported industry averages across all states but significantly BETTER than actual results in Florida between 2016 and 2019, where losses occurred and claims averaged 117.5% of premiums.

Running the Model

Logic in the model generates multiple outputs for review, starting with a visualization of the market territory reflecting the position of each policy and a color coded representation of its coverage value. The policies are also summarized in histogram format to reflect the skew of values. In this run, values were randomly generated using a base value of $280,000 and a variance of $170,000 used to create higher values skewed to the northeast and southest. While the average coverage amount was $403,950, the highest amount was $3.4 million.

After synthesizing policies, the model runs a loop to generate events, calculate losses and summarize them in graph form. The example below shows the result after a run with a single hurricane that struck in the middle of the west coast:

| Simulation# | Premium Revenue | Claims | Profit (Loss) |

|---|---|---|---|

| 1 | $425,763,762 | $550,740,777 | ($ 124,977,015) |

| 2 | $425,763,762 | $614,799,911 | ($ 189,036,149) |

| 3 | $425,763,762 | $1,130,111,065 | ($ 704,347,303) |

| 4 | $425,763,762 | $762,164,763 | ($ 336,401,001) |

| 5 | $425,763,762 | $507,798,613 | ($ 82,034,851) |

The average loss across the simulations with one hurricane is $287,359,264 with a payout ratio of 507/426 or 119.0%, which is pretty close to the number reported for Florida insurers in 2021.

Losses for the simulations with two hurricanes obviously get much worse.

| Simulation# | Premium Revenue | Claims | Profit (Loss) |

|---|---|---|---|

| 1 | $425,763,762 | $708,897,085 | ($ 283,133,323) |

| 2 | $425,763,762 | $811,872,203 | ($ 386,108,441) |

| 3 | $425,763,762 | $1,195,630,796 | ($ 769,867,034) |

| 4 | $425,763,762 | $666,877,073 | ($ 241,113,311) |

| 5 | $425,763,762 | $1,103,722,344 | ($ 677,958,582) |

The average loss for two hurricanes is $471,636,138 across the simulated 68,000 customers with a payout ratio of 1103/426 = 258.9%.

The highest claim amounts from the set of simulations involved hurricanes that crossed the high-value sections in the northeast and southeast corners of the market where home values skewed up into the $800,000 to $1,200,000 ranges. On one hand, the simulation of property values may have too evenly skewed values upward in those areas rather than scattering (say) hundreds of multi-million dollar homes amid tens of thousands of homes still around $390,000. On the other hand, the logic used to simulate hurricane impacts was likely more forgiving than reality. The model logic limited damage to about 1.3 times the coverage amount and cut off damages within a fifteen mile path from landfall. Category 5 hurricanes have pushed storm surge water THIRTY miles inland, causing far more extensive flooding damage.

All fifteen event simulations (five with zero hurricanes, five with one, five with two...) can be watched here:

Investment Implications

Mathematically, to the extent this model of Florida is roughly indicative of market forces in real Florida, a few financial conclusions become very obvious.

Unique Florida Market Dynamics

Given the above model for a single insurer with 68,000 policies, a two-hurricane year would trigger underwriting losses of $471 million dollars and average claims of $897 million just for those 68,000 customers. Since 68,000 is one percent of the roughly 6.8 million total policies, that implies a statewide loss of $89.7 billion for two hurricanes. That's actually within an order of magnitude of possibly being correct. Hurricane Idalia alone has already been estimated to have caused $10 billion in damage as a predominately Category 3 storm. But it seems unlikely that many insurance companies will pay out $897 million for their share of the total customer base. As mentioned earlier, this is probably correct because four out of five Florida homeowners do NOT have flood insurance and any of these homeowners hit with storm surge will NOT be covered. Those losses WILL be incurred, but solely by the homeowners.

The fact that Florida insurers are encountering repeated underwriting losses -- even with exclusions for storm surge and flooding and even in years with NO HURRICANES -- means markets have not adjusted premiums to reflect risks from the good old days prior to climate-driven killer storms. The model showed insurers aren't even consistently breaking even in a year without a hurricane. The failure to raise premiums to appropriate levels could be driven by multiple factors.

Insurers may have relied upon storm surge exclusion language to guard against hurricane claims while ignoring the risk of higher losses from tornados and wind damage often correlated with hurricanes after they make landfall. Insurers may have over-optimized claim handling processes that attempted to streamline back-and-forth communications between contractors and adjusters as repair work is done in ways that drove vast amounts of claim fraud. Contractors would gain approval from a homeowner to deal directly with the insurer to replace a roof, then jack up work and materials quotes hoping the insurer would blindly pay the higher amounts without sending out an adjuster to validate. This problem is not unique to Florida but there is CLEARLY something unique about its implementation in Florida -- the state generates 9% of all insurance claims in the US yet accounts for 79% of all insurance fraud litigation in the country. The fraud here is likely split 50/50 in both directions -- insurers falsely denying legitimate claims and contractors submitting inflated claims for work not needed or even performed.

National Market Dynamics

A key goal in crafting the model was to highlight how simultaneous / correlated loss events pose unique threats to insurance profitability. Correlated "mass loss" events are difficult to mitigate because the statistics behind event probabilities are typically assumed to be in "black swan" range (high unlikely and hard to imagine) and the magnitude of losses can quickly erase any financial cushion built up over time. Insurers cannot mitigate this risk by selling more policies into the same pool -- doing so MAGNIFIES the exposure. Insurers cannot blindly "diversify" by selling policies in other markets unless they are confident market B is not equally exposed to similar correlated losses as market A.

These problems are not limited to insurers in Florida. Insurers in any market with exposure to hurricanes, floods, wildfires, earthquakes or tornados face an identicial problem. These "mass loss" event risks DO appear to be rising, but no one can predict by how much. Of course, that's not the real problem for these insurers. Even if they could derive the new risk numbers, crunch their internal models and come up with adjusted premiums to charge customers, a more fundamental problem exists… Many customers cannot afford the higher rates. This is a reflection of two fundamental problems in the US economy -- an income inequality problem and a shortage of affordable housing.

Imagine a homeowner with the following household budget:

| Component | Value |

|---|---|

| Household Income | $87,000 |

| Federal Taxes | $14,700 |

| State Taxes | $4,350 |

| Payroll Taxes | $6,786 |

| Monthly Takehome | $5,097 |

| Home Price | $310,000 |

| Down Payment (20%) | $62,000 |

| Home Loan | $248,000 |

| Mortgage (7%) | $1,650 |

| Monthly Home Insurance | $400 |

| Monthly Car Payment | $682 |

| Monthly Car Insurance | $125 |

| Monthly Gas ($3.87/gallon) | $161 |

| Monthly Utilities | $150 |

| Monthly Food | $1200 |

| Monthly Health Insurance | $700 |

| Monthly Net Savings | $28 |

$87,000 is the median household income in the US for 2022. For this household to afford another $3000 in homeowners insurance, they would need to save $250 on some other monthly expense. If they could find a $272,000 home and only have a $1447/month mortgage payment, that would do it. But the entire population cannot all move to a cheaper home, the supply isn't there.

Of course, what these considerations REALLY mean is that many Americans are living in a location they cannot actually afford to live in, when the true risks that apply are accurately accounted for.

Individual Implications

The real lessons from the model are important to people at an individual level, and not just those currently living in an area at risk of these types of events. These considerations are worth reviewing for

- anyone contemplating retiring and moving to a new location or staying put in a risky location

- anyone exiting school and contemplating starting a career in a new location

- anyone contemplating a mid-career job change or employer change requiring a relocation

Insurance companies cannot ignore the costs of these risks and will not voluntarily absorb them. Since residential insurance is typicaly purchased on a yearly term, an insurance company's worst case risk horizon is one year -- the minute they know underwriting losses cannot be made up within one or two years, rates will rise or they will stop renewing policies and writing new policies. Either way, numerous risks face individual homeowners in this sitation.

First, no bank is going to lend $248,000 dollars for a home which cannot be insured against a risk which is VERY likely to destroy it within the loan term unless the borrower has other SIGNIFICANT collateral to offer up to secure the loan. And frankly, if they did, they might not be borrowing the money in the first place. Since the number of people with the liquidity to buy a home in cash or offer a bank other near-cash collateral instead of the home itself is small, a contraction in the availability of insurance will lower home prices across the ENTIRE market. Even if an individual homeowner is wealthy enough to afford a house without insuring it, they will not enoy the typical upward price support produced by wider loan availability. This will act as a growing DEPRECIATION force on an asset that is the single biggest component of many people's net worth.

Second, once a home in such a market is purchased, any reduction in demand and lending supply means an existing homeowner trying to SELL is going to wait longer for their money. It's one thing for a house to decline $30,000 to $60,000 thousand in value as insurance premiums skyrocket and loan availability shrinks. It's another for a homeowner who is already going to forgoe $30-60k to also have to wait far longer to sell the home to get their money out. Given that many households have little net monthly savings, this poses an instant LIQUIDITY problem for most homeowners who cannot afford two mortage payments or a mortgage and a rent payment for even a month.

Third, when a catastrophic loss occurs requiring a complete rebuild, it seems likely that actual coverage amounts will fall short of actual costs. Barebones policies often only cover depreciated value so components like roofing and appliances that are viewed as wearing out are only covered on a prorated basis based on the age of the home. More expensive policies cover "actual replacement costs" but "actual costs" are still capped by the coverage amount purchased. A house purchased 25 years ago for $200,000 that would now sell for $510,000 might require $460,000 in replacement costs for the dwelling. If the house is lost to a fire and needs to be rebuilt, it might be possible to rebuild the home for $460,000. If instead the home is wiped out with 150 other homes in the same ZIP code due to a flood or hurricane, it is unlikely $460,000 will cover the costs. Instead of one contractor competing for raw materials and trade labor for the rebuild, demand for those resources has jumped by a factor of 150, just in that local market. In a post-covid world of constant supply chain shortages, imagine 10,000 homes all needing a new air conditioner or furnace at the same time. Getting the work completed will either involve higher cost or a longer wait (triggering other costs) or both.

Does a contraction in insurance markets away from at-risk regions mean NO ONE should live there? That's not only a personal financial and quality-of-life choice but an important public policy topic as well. If insurers withdraw coverage from a beach or mountain retreat, that doesn't immediately suggest no one can or should live there. It means those choosing to do so must understand the physical and financial risks before purchasing and they should be capable of absorbing those risks without a public financial backstop.

Someone worth $20 million wanting to live in a million dollar home in a hurricane zone is more than welcome to build and own a home in that environment. Just don't expect FEMA disaster relief to rebuild. If you want insurance coverage, be prepared to pay whatever the insurer demands or just self-insure and eat the loss and rebuild out of your own pocket.

In contrast, someone struggling to afford a major car repair, save up for their next car or save for college does not have the income and liquidity to tolerate that type of risk. They shouldn't be enticed into doing so by government programs that artificially hide the true cost of living in such a location or subsidize that cost by spreading it across a much larger pool of consumers who have the sense to avoid that risk. If it was merely unfair to the rest of the public but in fact covered the risk, that would be one thing. The point here is that even with incorrectly set insurance rates, when a loss IS incurred, that policyholder still faces a material risk of being completely financially wiped out, whether from denied claims, under-insurance or an inability to handle duplicated expenses during a long rebuild.

Perhaps the best way to phrase the dilemma facing individual customers is this:

When pondering a decision on where to buy a home,

- assume every player you deal with has closed many more of these deals than you

- assume every player you deal with thoroughly understands THEIR risk in the transaction

- assume every player has structured their portion of the deal to protect THEIR financial interest and to carry that risk for as short a period of time as possible

- since you are the least knowledgeable player at the table, assume everyone else has figured out a way to transfer as much of their risk to you as possible

In general, the real estate agent will make money. The builder will make money. The bank will make money. The insurance company will make money. Most of the risk facing other parties has been transferred to you. The bank required a down payment, giving them extra pricing room to reposess and quickly sell the house without taking a loss if you default. The bank required insurance to ensure they could be paid off if the house was destroyed. The insurance company is only exposing itself to risk one year at a time and will cut its losses at the drop of a hat. The builder has all of his money at closing. The only person facing all of the risks for the long term is you.

Taking a risk of buying into a market or remaining in a market with the the type of financial risk illustrated with this what-if modeling and real-life headlines merits serious thought. Your long-term financial livelihood likely hinges on it.

WTH

External Sources

General insurance statistics on claim rates, loss types, etc.:

https://www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insuranceTop 25 insurers in Florida

https://www.alliance321.com/top-homeowners-insurance-companies-in-florida/Flood insurance costs in Florida

https://wusfnews.wusf.usf.edu/weather/2023-05-21/flood-insurance-costs-soar-florida-see-expected-increases-zip-codeFlorida underwriting profits / losses from 2006 through 2022

https://www.insurancejournal.com/news/southeast/2023/07/11/729431.htm